High-Performance Recovery.

Human-Centric Results.

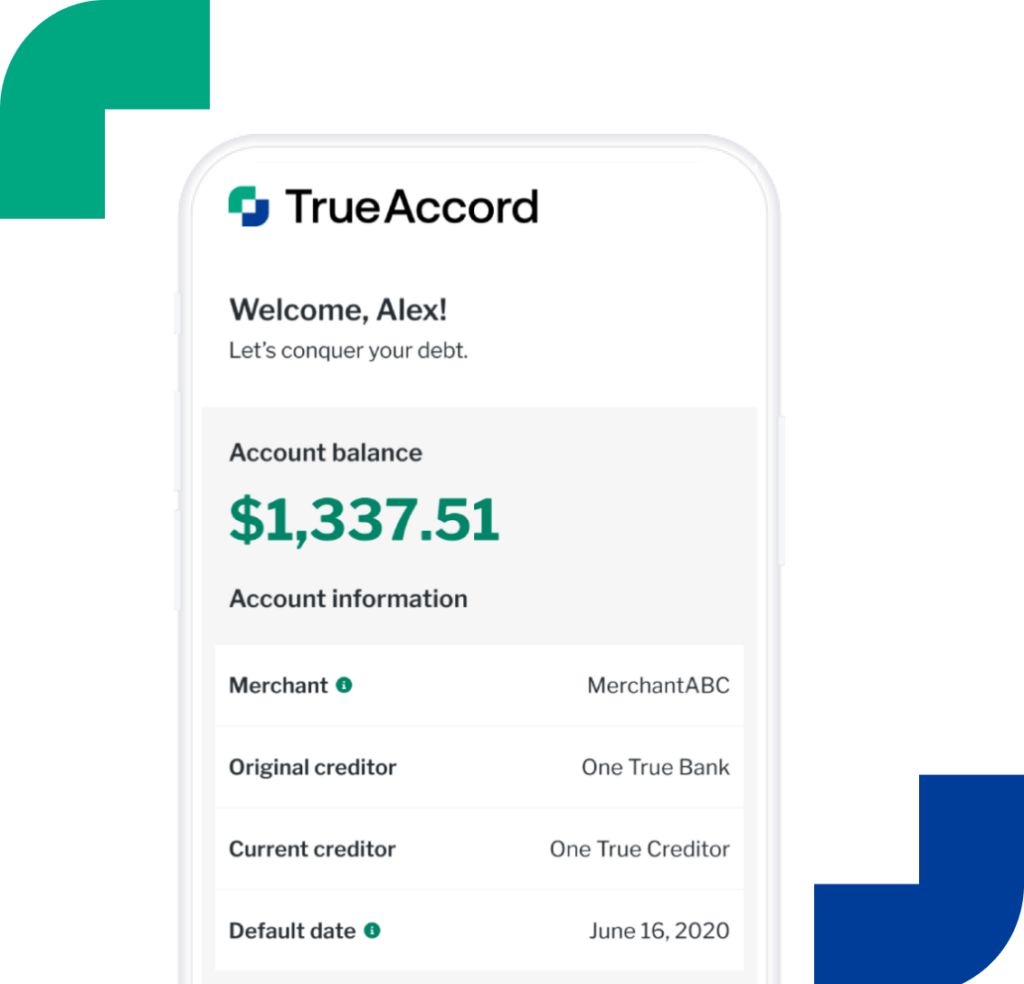

TrueAccord is the premier omnichannel debt collection agency, leveraging data science and AI technology to deliver superior results with a consumer-friendly experience.

Full-Lifecycle Recovery Solutions

TrueAccord adapts to your delinquency lifecycle, from early-stage re-engagement to late-stage recoveries.

| Recovering As You (First Party)* | Recovering For You (Third Party) |

|---|---|

| Seamless brand and team extension | Premier omnichannel agency |

| Focus on retention and education | Focus on liquidation and resolution |

| AI + Human for optimized re-engagement | AI + Human for high-volume repayment |

*Offered by TrueAccord’s subsidiary, Sentry Credit, Inc.

Trusted by Market Leaders. Loved by Consumers.

HumAIn Financial Solutions™

Behind every account is a human. Their debt collection experience directly impacts your business financially, legally, and reputationally.

TrueAccord’s collection strategy utilizes HeartBeat™ to eliminate the guesswork of collections, allowing our agents to spend 100% of their time on what matters: helping pre- and post-delinquency consumers find a way forward.

Our first-party and third-party collections services help your business put consumers first, so every dollar recovered makes a difference.

-

Performance

25% Higher liquidation than many competitors

-

Scale

25+ million accounts daily

-

Expertise

95+ Clients, including leading debt issuers and buyers

Scalable,

Reliable Recovery

Performance

A Decade of Compliance Stewardship

Leading With Consumer Empathy

Omnichannel Is the Best Channel

In this data-driven eBook, compare traditional outbound calling methods versus a digital-first, omnichannel approach for debt collection.